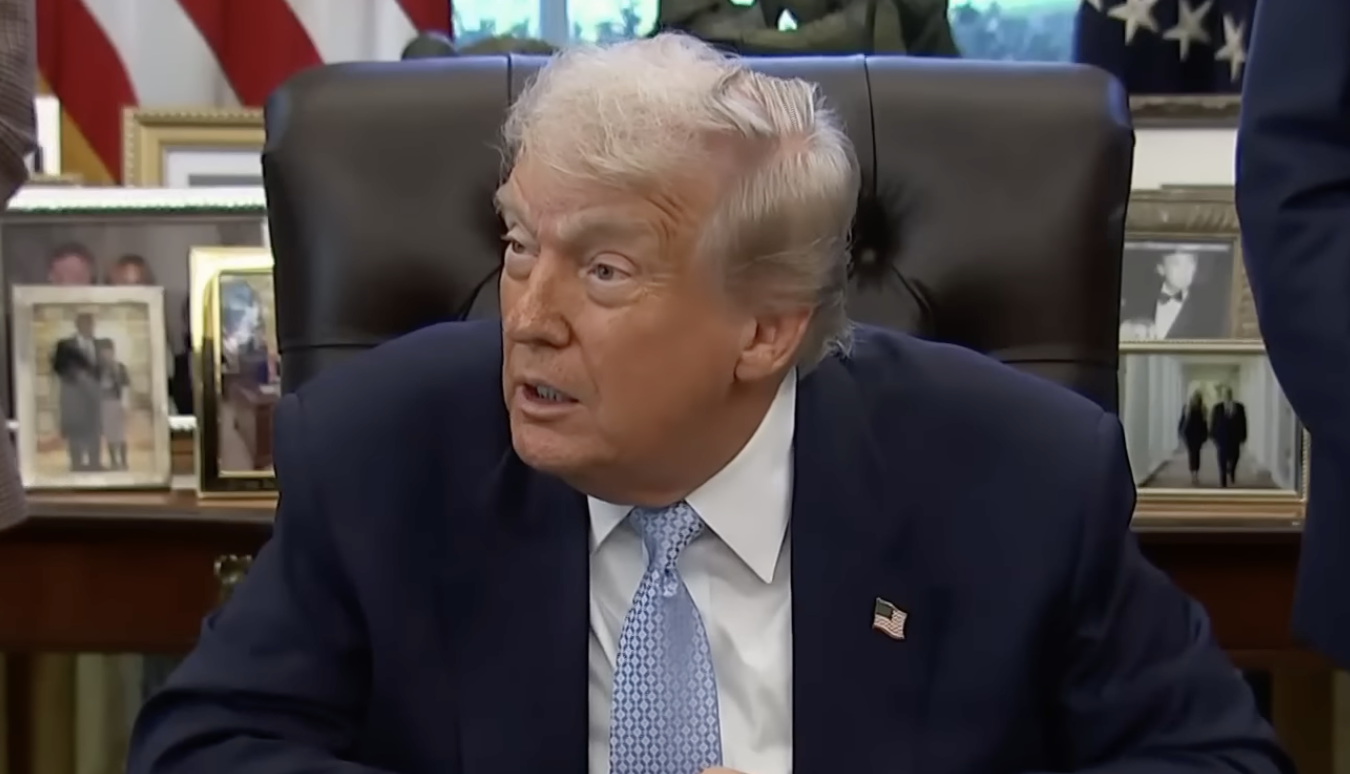

On 9 November 2025, Donald Trump posted on his social-media platform that every American citizen would receive a “dividend of at least $2,000 a person (not including high income people!)” as part of a plan to share revenue raised through new tariffs. He described the payout as a benefit made possible by collecting “trillions of dollars” of tariff revenue. The announcement came amid his push to portray tariffs as both a mechanism for boosting U.S. manufacturing and delivering direct cash benefits to citizens.

However, the proposal lacks detailed implementation plans. Key questions remain unanswered: who qualifies as “high income” and thus excluded; when the payout would be made; whether children or dependents would also receive payments; and how the payments would be funded. The administration has offered conflicting statements about the form the dividend might take, including remarks from Treasury Secretary Scott Bessent that the payout could come “in lots of forms, lots of ways” and might amount to tax-savings or credits rather than a straight cash cheque.

The revenue source cited by Trump is the broad expansion of tariffs the U.S. government has imposed during his second term. Trump stated that tariff receipts would allow a dividend to citizens while simultaneously reducing the federal debt. That stated link between tariffs and direct citizen payments is unprecedented in U.S. fiscal policy.

Analysts have raised serious doubts about whether the plan is feasible. According to the non-partisan Tax Foundation, a $2,000 payment to each adult earning below $100,000 would cost around $300 billion, and more if children were included. By contrast, actual tariff revenue is estimated significantly lower: in the first three quarters of fiscal year 2025 the U.S. collected around $195 billion in tariffs, and the projected costs of the dividend could far exceed that figure.